Guru’s Blogs

The Power of the Mind. “Humans are disturbed not by things, but by the views they take of them.” — Epictetus. An old story for today.

Wŏnhyo, a Korean Buddhist monk, was travelling to China long time ago to study Buddhism.

Charlie Munger liked to joke, “At my age I don’t even buy green bananas.” Yet he kept making bold, long-term decisions until weeks before his 100th birthday.

Munger studied meteorology at Caltech and law at Harvard, but in the real world, he refused to live inside academic fences. He learned from everywhere.

Differentiation is Survival and the Universe Wants You to be Typical. One last thing of utmost importance Jeff felt compelled to teach all Amazonians in his final shareholder letter as Amazon’s CEO.

Here is a passage from Richard Dawkins’ (extraordinary) book The Blind Watchmaker. It’s about a basic fact of biology.

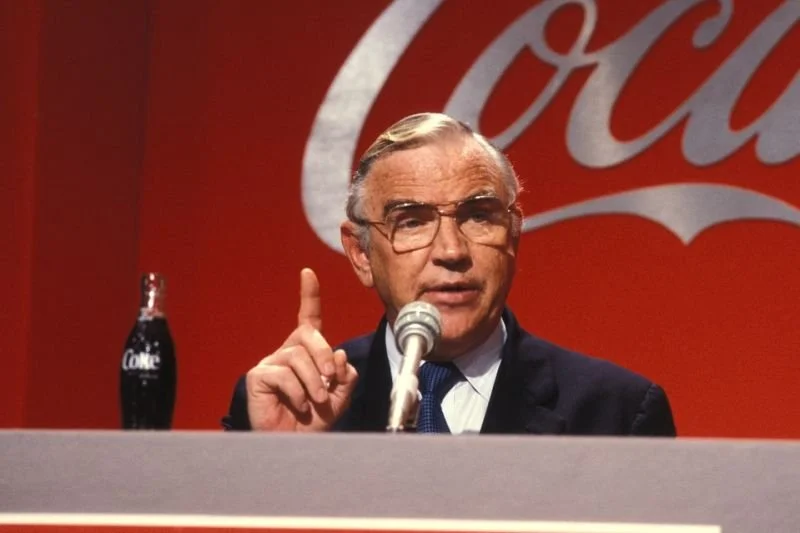

Don Keough — The “Supreme Idiot” Who Grew Coke's market cap from $2B to $120B and Left a Masterclass on Failure.

I read Warren Buffett’s Thanksgiving letter over the weekend, and it sent me down a rabbit hole into the life and wisdom of Don Keough.

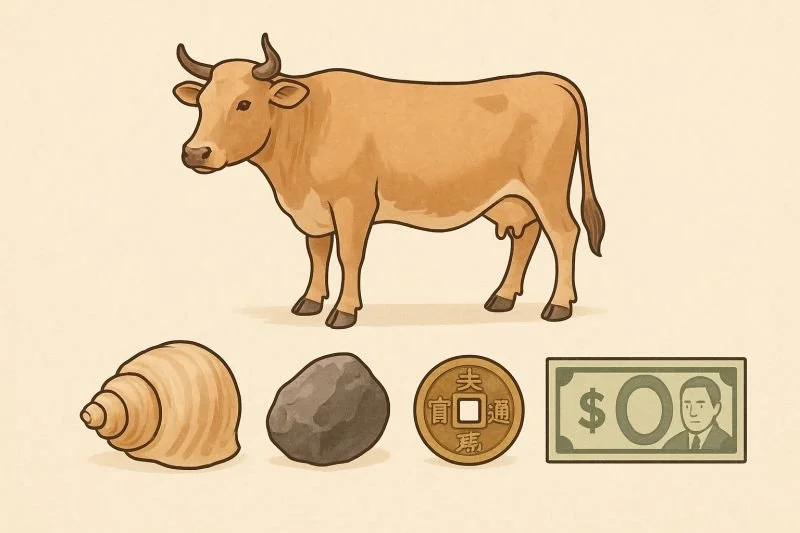

The Collective Delusion Called Money. Nobody complains about gravity, but everyone complains about money.

Money has always been a psychological, tribal consensus, a shared belief at a point in time, not an undisputable scientific fact.

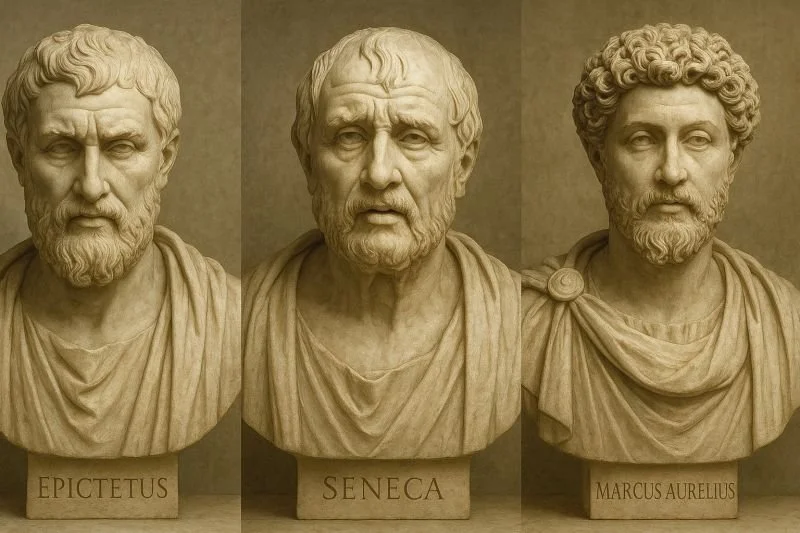

4 Rules for a Better Life from the Stoic Triad. Epictetus the teacher, Seneca the writer, and Marcus Aurelius the emperor.

The Stoics lived two thousand years ago, but their wisdom feels tailor-made for today’s distractions.

They taught that peace doesn’t come from controlling the world; it comes from mastering our thoughts and actions.

The Thumbs-Up That Changed the World. Like it or not, the Like button has reshaped our economy, influenced politics, rewired human behaviour, and even nudged evolution itself.

It started with a sketch on a napkin.

On May 18, 2005, a Yelp employee named Bob Goodson doodled two crude symbols — a thumbs up and a thumbs down.

Your difference is your advantage. Don’t trade it for imitation. The law of comparative advantage reminds us that the more different you are from others, the more valuable you are economically.

People are valuable because they are different. Everybody is unfathomably different from everyone else, yet society rarely harnesses that individuality.

Nothing more uncommon than common Sense. Here’s a story from the past that could save you a lot of time and maybe a few million dollars.

During the height of the Cold War, the United States and the Soviet Union were locked in a race to be the most technologically advanced nation.

Here’s one way to live - Create.

“The most valuable real estate in the world is the graveyard.

There lie millions of half-written books, ideas never launched, and talents never developed.

The Box That Changed the World. A small idea, combined with simple technology, doubled global GDP, boosted productivity, and created millions of jobs.

Malcom McLean was born into a farming family in North Carolina in 1914. During the Great Depression, he helped support his family by starting a small trucking company to move farmers’ goods. By 1940, his grit and resourcefulness had grown the business to thirty trucks.

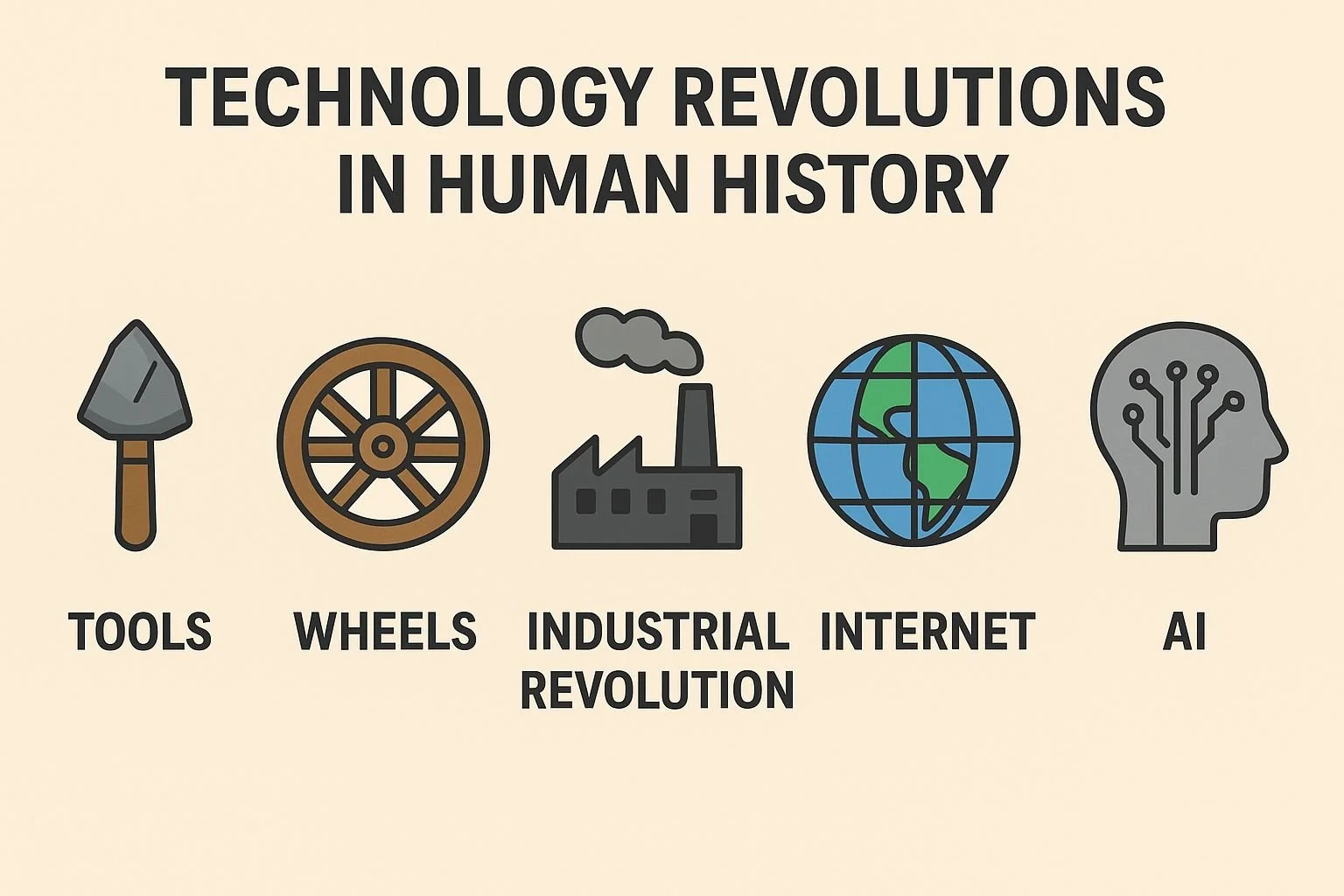

Machines won’t take your job. But humans who act like Machines will lose theirs. For the past 200 years, we’ve learned to work with machines to stay employed.

Machines have mastered connecting the dots looking backward. They can sift through mountains of data and see patterns we’d miss. Competing with them here is a wasted effort.

Poor, Rich & Wealthy: The Difference No One Tells You

The Rich also trade time for money, but at a higher hourly rate. They’ve built a rainy day fund, maybe six to twelve months of expenses saved. But their financial security still depends on their continued effort.

Can you predict the future impact of AI? One cannot connect the dots looking forward; you connect them looking backward and then apply mental models to guesstimate future directions.

Let’s try a thought experiment. Travel back with me to 1999/2000. Everyone knew the internet would change everything, but nobody could predict how and who the winners would be.

In Gold We Trusted, but now In God We Trust. From Gold to Handbags: The story of fragile trust behind money.

Until 1970, every major currency in the world was backed by gold reserves. The post-war Bretton Woods system pegged the U.S. dollar to gold at $35 per ounce, while other currencies (pound, franc, yen, etc.) were pegged to the dollar within narrow bands.

The Unusual Story of Money Since 2020.

The world came to an abrupt halt in 2020 with the outbreak of COVID-19.

Overnight, streets emptied, factories shut, and economies froze. Echoes of the Great Depression resurfaced, marked by mass unemployment, food insecurity, bankruptcies, and even rising social unrest.

My first job didn’t exist when my mother started working. Her job didn’t exist when my grandfather started his career. Tomorrow’s jobs don’t exist today.

My grandfather spent his entire career with Indian Railways, retiring happily as a Station Master. Railways were the high-tech sector of his time.

What comes to mind when I say “Tyre Company”? Chances are, it’s not sophisticated fine dining from the best chefs in the world. Yet, that’s exactly the surprising story behind the Michelin Stars.

In 1900, France had only about 3,000 cars on the road. Business was looking bleak for brothers Édouard and André Michelin, owners of Michelin Tyres.

Eric Olson, a retired US Navy Admiral with a distinguished career in U.S. Special Operations, often shares hard-earned leadership lessons. One particular story stayed with me.

In Afghanistan, U.S. Civil Affairs teams were deployed not just to be present, but to add value—to dig a well, install a pump, or build a clinic. As Olson puts it, “Presence without value is perceived as occupation.”

A few dumb decisions smart people still make. Even the brightest minds can stumble.

1. Neglecting Health

Smart people often work tirelessly, pushing themselves to succeed—only to ignore their physical and mental health. Eventually, they find themselves unable to enjoy the very fruits of their labor.